Bid Ask Spread when Market Making

Another great post from MenthorQpro -https://www.menthorq.co/blog/bid-ask-market-making

Oct 23, 2023

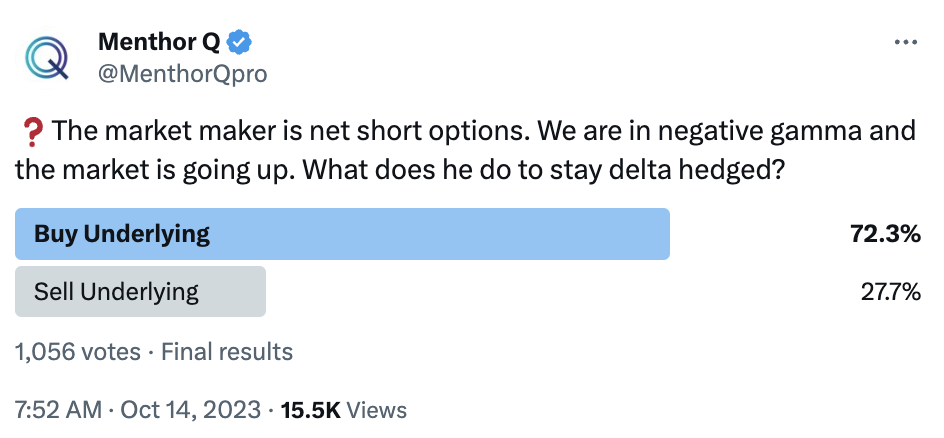

Last week we asked a question on X. You can find it here.

We realized that the question was very simplified and many of you wanted our answer. We decided to dedicate this week’s newsletter to this question. Because it is true, it can be more complicated. So let’s break it down first.

What is the Market Maker doing?

Everyday the market maker is doing two things:

- Showing a bid and an ask to try and capture the spread between the two as profit. The market maker will have his own model that gives him an option theoretical value. If the model is good enough he wins basis points here and there.

- But as important is his second daily function: risk managing the inventory it has on the book.

Why is the Bid / Ask Spread important?

The width of the bid ask spread is important for the market maker. While there are exchange restrictions, it is also a matter of competition, because if he is quoting too wide, he may lose business.

The width of the market becomes a crucial factor for the market maker when it comes to risk management. If the width is too narrow, it may not provide sufficient protection against potential losses.

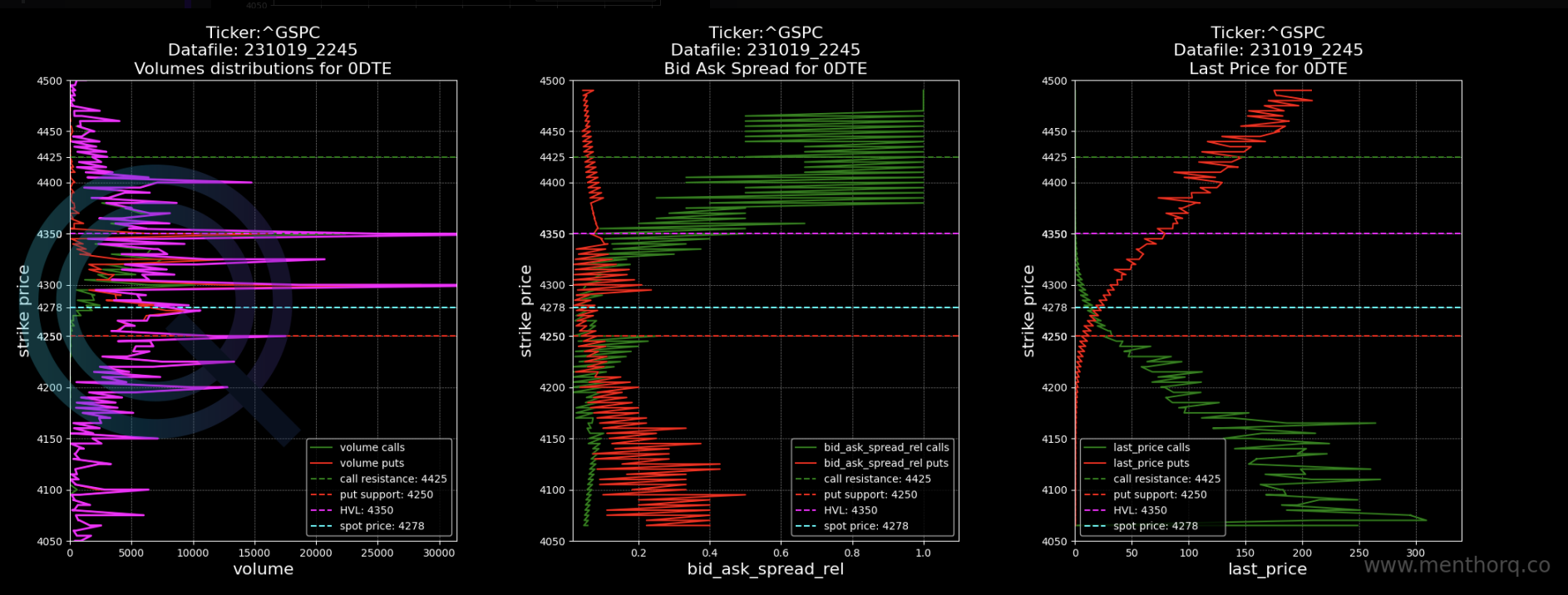

We track the bid ask spread via our models here below. It is just a good way to see which strikes are wider and which ones are narrower.

If all of a sudden strikes become wider, that means, liquidity is drying up. Obviously for an index like SPX a big widening is not common, but what this can do is show you what strikes have more liquidity, hence the ones where there is more volume/demand.

How wide is that bid ask spread?

The market maker needs to think about how likely and how much the option’s value might change. If an option strategy is valued at, for example, $1 and has low risk, it won’t change much with small market moves.

In such cases, the market maker can keep their spread narrow. On the other hand, for assets with stable prices, it’s smart to buy them a bit below their estimated value or sell them slightly above it.

But if an asset’s value can change a lot and often, the market maker should have a bigger spread because of the higher risk. In simple terms, when there’s more uncertainty, the market maker should have a wider spread.

How does the market maker look at its exposure?

The market maker does not look at the exposure of each options in isolation. He will spread related options against each other in a way to aggregate risk.

For example, let’s assume the market maker is long, that will mean he is long gamma, vega and short theta. This means that most likely the market maker will not be interested in adding more length to his book. He would instead be looking at selling.

How does the option market maker hedge?

I think there is a lot of information out there on how a market maker hedges risk. But let’s quickly review here. The primary activity is that of delta hedging, and these are the risk associated with that activity:

- Delta: when the underlying changes that moves the delta.

- Gamma: this is how much the delta of an option changes for a given change in the price of the underlying asset

- Vega: the sensitivity of an option’s price to changes in implied volatility

- Theta: this is the time decay

The market maker’s objective is to maintain a neutral position that minimises exposure to adverse market movements that will change those primary greek’s risks.

Back to our question

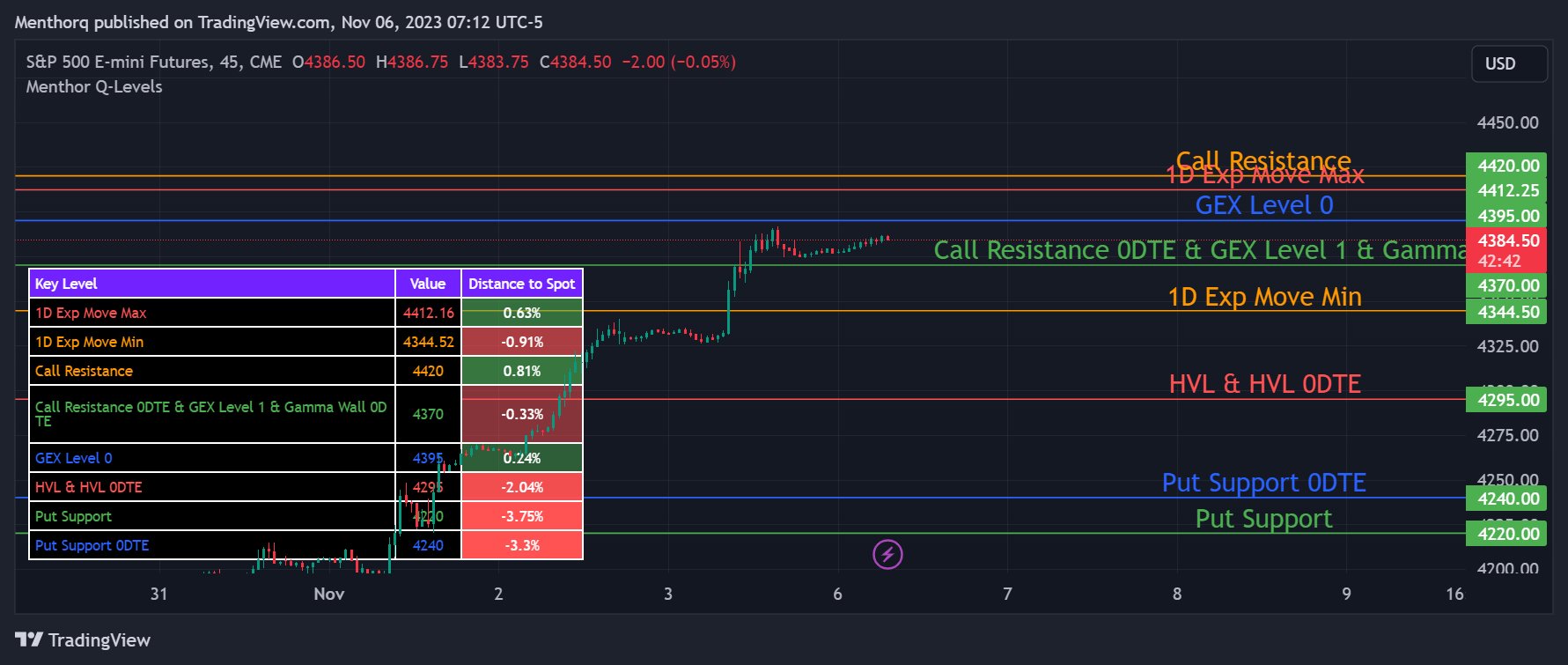

In that question, we asked how the market maker would have to reposition if he was net short options in negative gamma with the market going up.

The first important point we did not ask is what type of options he was short.

Obviously being short ATM options versus OTM options is completely different for the market maker, because volatility would have a different impact on its delta.

If the market is in negative gamma, we know that volatility is high. However, in the example, the market is moving up, that means that IV is probably down and potential towards the High Vol Level.

In this case the market maker that was short gamma, would be buying the underlying/reducing short to re-hedge.

Now, while this helps us understand the management or risk of the option, it is not entirely correct. As we said, the market maker would be looking at the portfolio in its entirety. He would never really be short options.

Usually he would have some other options at other strikes higher/lower or same strikes further out of the curve in terms of expiry to make sure he is flat.