Original post – https://www.menthorq.co/blog/vanna-options-trading

The importance of Vanna in Options Trading

Oct 29, 2023

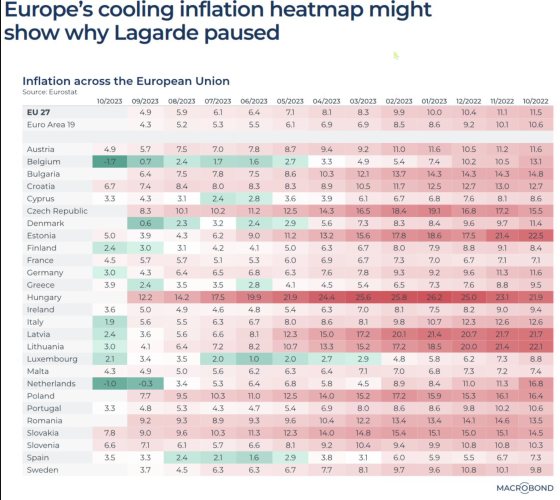

This week we are going to look at how the delta of the market maker changes based on greeks and spot price. It is a good time to cover this, because there is a lot of volatility in the market. Of course the geopolitical events are driving a lot of this, but it is always important to understand what happens below the hood. Because many times, certain moves while inexplicable based on what is happening, do have a technical explanation.

At this point, those that follow us know that we try to explain how liquidity is moving the market, and specifically when positioning in the option market changes. Since there is a lot to cover, we will split these concepts in two different articles.

Today we will cover:

- Delta

- Gamma hedging

- Vanna Hedging

In the second part, next week we will put all of this together and cover the following:

- How OTM options can have a meaningful impact on the market when there is a change in volatility because of Delta hedging.

We will try to keep it short and sweet as usual. But these are important topics that you want to add to your understanding of markets as a trader. Not only to make money but to also understand how to risk manage your book. We will also use our models to show you how to track some of these changes.

The Delta

We have covered Delta already in a blog post.

In this post you should be able to understand what Delta is, when it becomes more positive and when more negative. But you will also see (very simplistically) investor positioning vs market maker. We say simplistically, because in the past some of you have pointed out that this is not correct. While it is not incorrect, it is simplified.

Today we will go a step further in order to show how that delta hedge changes with gamma, volatility and moneyness. But before continuing reading, please take a look at that link.

Gamma Hedging

Most of you know what gamma is. Let’s revise quickly.

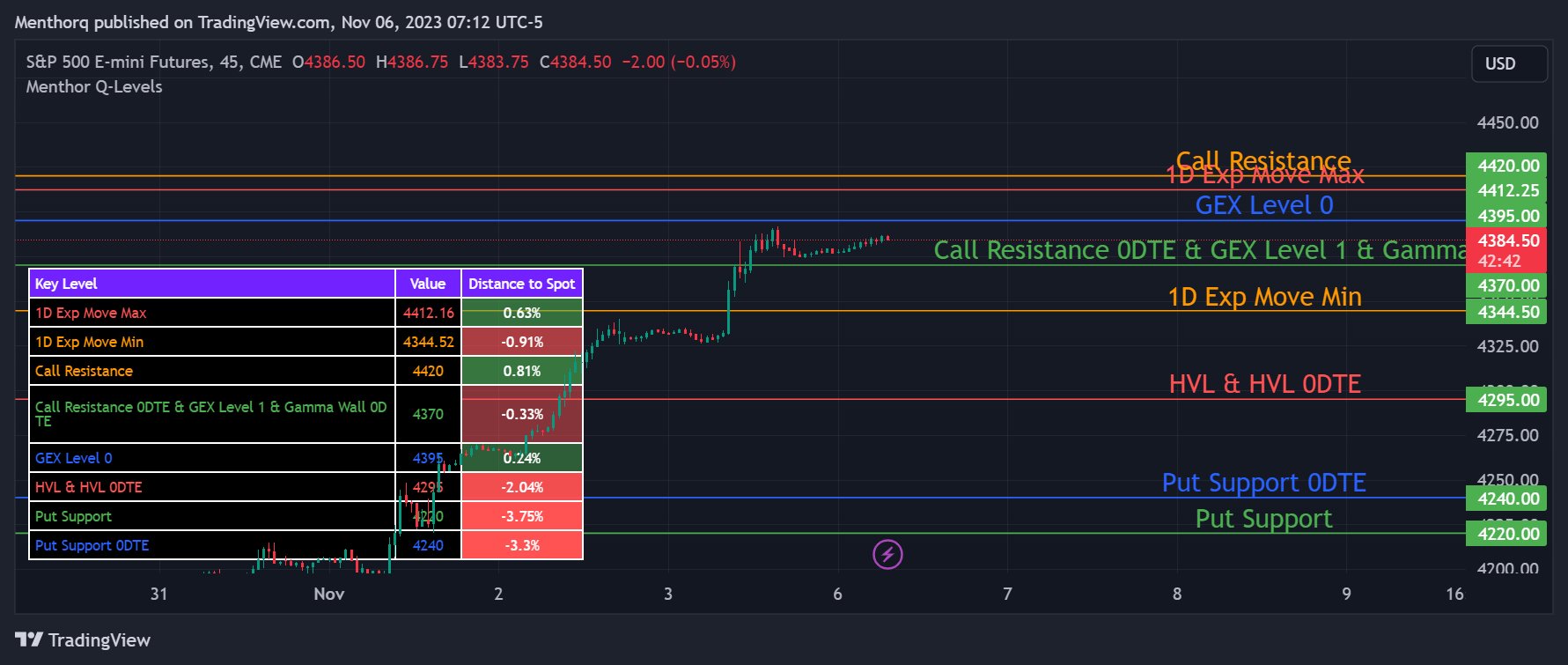

As the gamma of the option changes, so does the Delta. That means that if you have a 50 Delta call, also known as at the money, if your gamma is 20 your delta can potentially be moving in two directions:

- Up becoming a 70 Delta. To stay Delta hedged the market maker will have to short

- Down becoming a 30 Delta. To stay Delta hedged the market maker will have to go long

From a liquidity perspective, this is pretty straightforward. As the gamma moves that Delta, market makers will have to go long or short, meaning it will add or lower liquidity in the market as that delta changes. This is what we had in our Option Greeks & Volatility Trading Course. This is how a market maker is thinking about long and short gamma.

In this article we outlined the difference between positive and negative gamma. How you can tell from our models whether we are in positive or negative gamma, and the High Vol Level. This is another important tool that you want to become familiar with when trying to assess where the market is going in terms of liquidity. Please read this article before moving forward

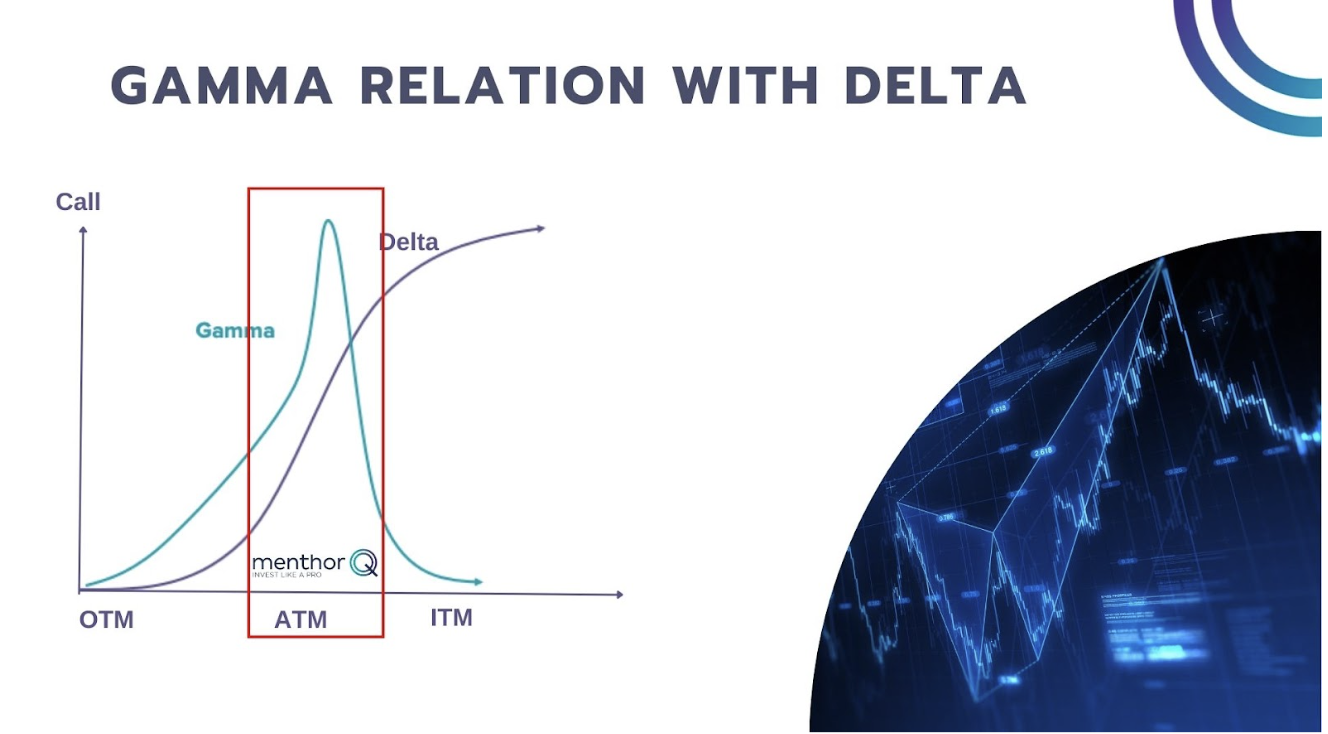

In this case, the concept of adjusting your hedge based on delta is then fairly simple. As you can see in the below chart, as the spot price moves, the moneyness of the options changes. If you look at the delta profile it then becomes clear that, when we move towards the OTM, the delta or the options goes lower, while when it goes up that delta goes up. To delta hedge, the market maker as we said before will go long or short the underlying.

Vanna

If delta hedging was only a matter of gamma hedging, things would be a lot easier. Because all you would have to do is really adjust your hedge for gamma. Unfortunately, we all know that what makes the markets “exciting” is implied volatility. When linked to hedging, we are really interested in vanna. You would have heard this concept on X before, but all it is, is the change of delta for change in implied volatility. Vanna is important because, as IV increases, it raises the deltas of maturities further from the strike.

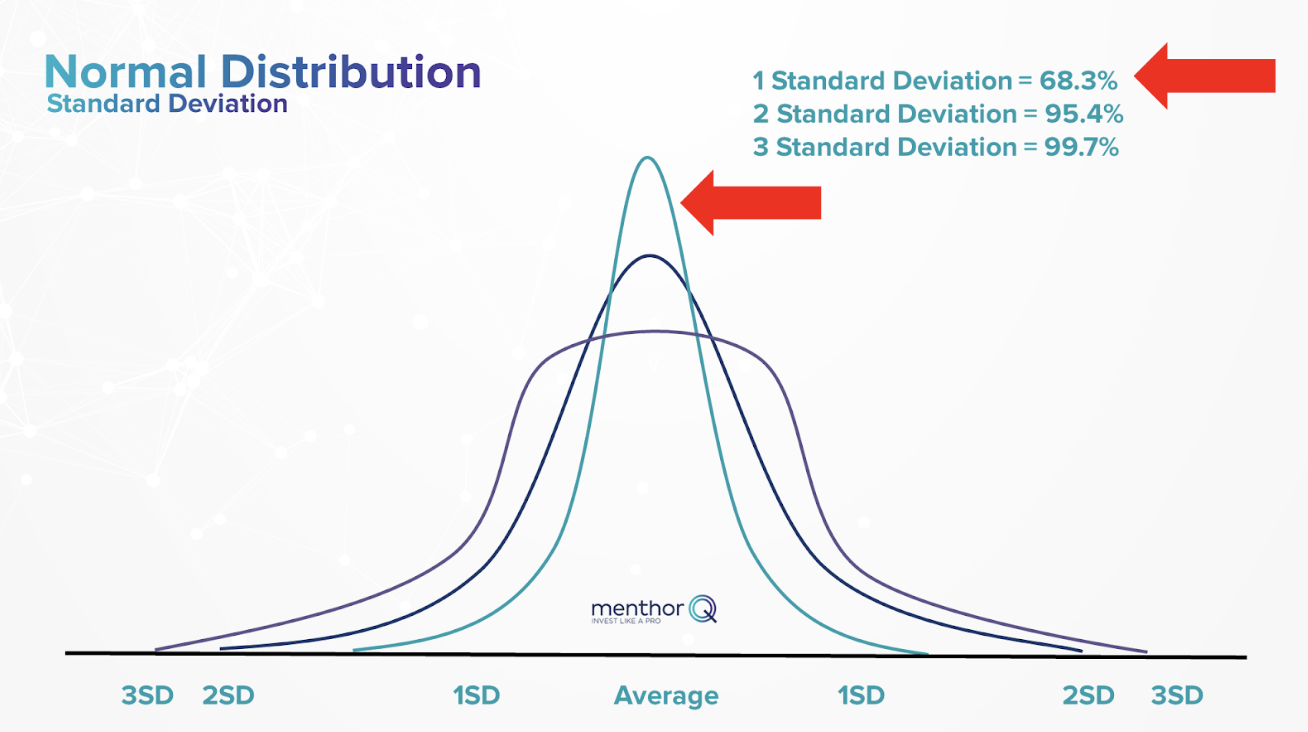

There are a couple of ways for us to understand this concept. By taking a simple normal distribution chart, what we see is that in a 1 standard deviation move, prices will be moving within this cone (red arrow).

That means that the price movements are less wide. Prices swing less. Now if we move to a 3 standard deviation move, all of a sudden we see that price changes can be a lot wider.

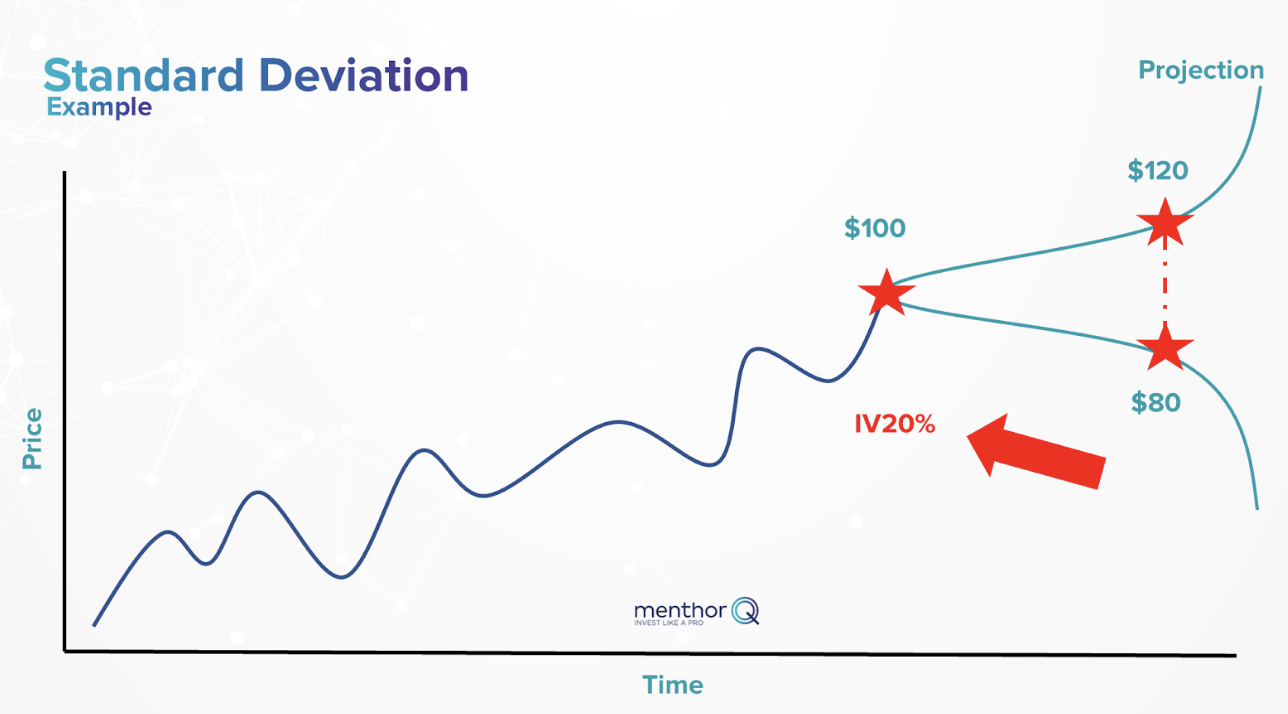

Those cones can be represented as follows just to make it easier to visualise. All of this we had covered in great detail in our course.

The higher the IV, the wider that cone, and the wider the cone the wider the price swings. Again, this will have an impact on the Delta and how the market maker has to hedge the book.

What should we know about vanna?

If vanna is large, then the delta hedge is very sensitive to a movement in volatility.

If Vanna > 0

- As IV increases, we will see an increase in delta for our option. This is because higher volatility tends to increase the likelihood of the option ending up in the money, which affects delta. But why is that? That is because, when there is no volatility, our option has no gas. Meaning, with no volatility, there is a less likelihood that our OTM option would go in the money. Yet, if volatility increases, our chances that the option goes in the money increase. So when we have positive vanna, with IV rising, delta starts becoming more sensitive.

Vanna < 0:

- If Vanna is negative, we have the opposite effect, the option delta is just less responsive.

Vanna is also why moneyness becomes more important to delta hedging. Let’s take OTM puts. Those can be on the tails of the market without really meaning much in a low volatility environment. However, as volatility increases, in terms of liquidity those can start having a big impact. Because all of a sudden, the market maker will have to start adjusting its delta as those OTM puts start getting closer to the money due to volatility. In those cases, as the delta increases, the market maker will have to start shorting the market to remain hedged, and that can have a deep impact on the market.

Next week, we will wrap this up, and explain why those Put Support levels become very important as volatility increases in negative gamma markets.